The world of stock and options trading offers a plethora of strategies to choose from, and the short straddle is one that deserves special attention. This article explores the intricacies of the short straddle strategy, providing insights into its mechanics, benefits, and risks.

Understanding Short Straddle

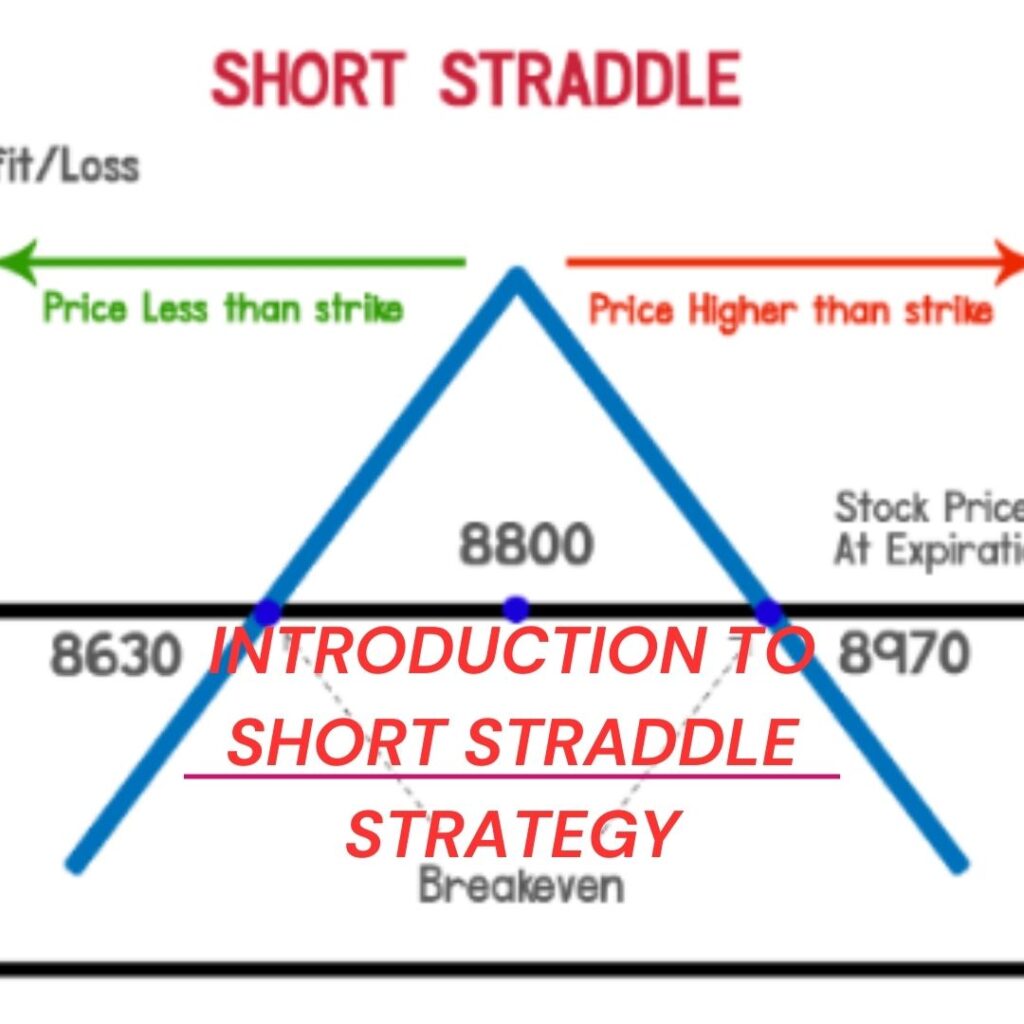

A short straddle is an options trading strategy in which an investor simultaneously sells both a call option and a put option with the same strike price and expiration date. The aim here is to profit from low market volatility, as the investor collects premiums from both options.

Pros and Cons of Short Straddle

- Pros:

- Limited risk, as the premiums collected provide a cushion.

- Profitable in low-volatility markets.

- Can generate income even if the stock price remains stable.

- Cons:

- Unlimited loss potential if the stock price makes a significant move.

- Margin requirements can be high.

- Time decay can erode profits.

When to Use a Short Straddle Strategy

Short straddles are best suited for markets with low volatility and when traders believe the underlying asset will remain stable in the short term. It can be used when you anticipate little to no significant price movement.

How to Implement a Short Straddle

To implement a short straddle:

- Choose a stock with options available.

- Select the strike price and expiration date.

- Sell both a call and a put option at the chosen strike price.

- Collect the premiums and wait for options to expire.

Risk Management in Short Straddle

Implementing risk management strategies, such as setting stop-loss orders and monitoring market news, is crucial when using a short straddle to limit potential losses.

Short Straddle vs. Other Options Strategies

Compare and contrast the short straddle with other options strategies like strangles, iron condors, and covered calls to understand when each strategy is most appropriate.

Real-World Examples of Short Straddle

Illustrate the short straddle strategy with real-world examples and case studies, showcasing both successful and unsuccessful trades.

Short Straddle in Volatile Markets

Discuss how traders can adapt the short straddle strategy in highly volatile markets, emphasizing the importance of adjusting strike prices and expirations.

Tax Implications of Short Straddle

Examine the tax consequences of short straddle strategies, including capital gains, losses, and tax reporting requirements.

Short Straddle: A Profitable Approach?

Explore whether the short straddle can be a profitable approach in the long run, considering the risk-reward ratio and historical performance.

Expert Tips for Short Straddle Success

Gather insights from trading experts and professionals on how to effectively execute short straddle strategies and maximize profits.

Short Straddle and Market Sentiment

Analyze the role of market sentiment and news in influencing short straddle positions and how to stay informed.

Risks Associated with Short Straddle

Delve into the risks associated with short straddle strategies, including market events, adverse price movements, and economic factors.

Conclusion

In conclusion, the short straddle strategy is a versatile tool in the options trader’s arsenal, offering unique advantages in specific market conditions. However, it is not without its risks, and traders must approach it with caution, always employing proper risk management techniques.

FAQs

1. Is the short straddle strategy suitable for beginners?

- The short straddle strategy can be complex and is best suited for experienced traders who understand options and risk management.

2. Can the short straddle result in unlimited losses?

- Yes, in the event of a significant price movement, the short straddle can lead to unlimited losses.

3. When is the best time to use a short straddle strategy?

- A short straddle is most effective in low-volatility markets when you anticipate minimal price movement in the underlying asset.

4. What is the difference between a short straddle and a strangle?

- A short straddle involves selling both a call and a put option with the same strike price, while a strangle involves different strike prices.

5. How can I manage risk when using a short straddle strategy?

- Risk management in a short straddle involves setting stop-loss orders and closely monitoring market conditions to limit potential losses.

In this article, we’ve explored the short straddle strategy from its fundamentals to advanced techniques. It’s a powerful strategy when used in the right circumstances but demands careful consideration and risk management. Whether you’re an experienced trader or just starting, understanding the short straddle can add a valuable tool to your trading arsenal.