Introduction

In the fast-paced world of financial markets, traders are always on the lookout for an edge that can lead to consistent profits. One approach that has gained popularity among traders is high probability trading. This strategy focuses on identifying setups with a higher likelihood of success, allowing traders to make informed decisions and potentially increase their profitability. In this article, we will explore the concept of high probability trading, how to identify such setups, the importance of risk management, and various strategies that can be used to achieve success in this style of trading.

Understanding High Probability Trading

High probability trading involves seeking out trades that have a higher likelihood of ending in profit. It relies on statistical analysis and historical data to identify setups that have demonstrated a higher probability of success in the past. This approach is not about making speculative bets but rather about finding opportunities where the odds are stacked in the trader’s favor.

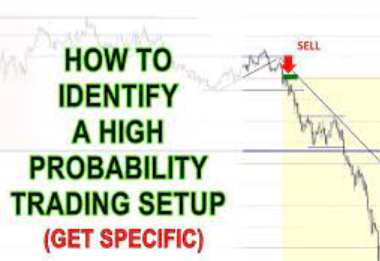

Identifying High Probability Setups

To identify high probability setups, traders often use a combination of technical and fundamental analysis. Technical indicators, chart patterns, and trend analysis play a crucial role in pinpointing potential entry and exit points. Additionally, fundamental factors such as economic data, company earnings, and geopolitical events can also impact the probability of a trade’s success.

Risk Management in High Probability Trading

While high probability trading can offer better odds of success, it is essential to remember that no strategy is foolproof. Traders must implement strict risk management techniques to protect their capital. Position sizing, stop-loss orders, and diversification are some of the risk management tools used to mitigate potential losses.

Technical Analysis for High Probability Trading

Technical analysis is a fundamental aspect of high probability trading. Traders use various indicators like moving averages, RSI, MACD, and Fibonacci retracements to identify potential entry and exit points. Chart patterns such as head and shoulders, double tops, and flags can also signal high probability setups.

Fundamental Analysis in High Probability Trading

In addition to technical analysis, fundamental analysis can provide valuable insights into the underlying assets. For example, understanding a company’s financial health or a country’s economic outlook can influence the probability of a trade’s success.

Building a High Probability Trading Strategy

Developing a high probability trading strategy requires a comprehensive approach. Traders need to define their trading goals, select appropriate markets and timeframes, and establish clear entry and exit criteria. A well-defined strategy helps traders stay disciplined and focused during volatile market conditions.

Emotional Discipline in High Probability Trading

Trading can evoke intense emotions, especially during periods of uncertainty. Emotional discipline is critical to avoid impulsive decisions that can lead to losses. Sticking to a well-defined strategy and maintaining emotional balance is key to success in high probability trading.

Backtesting and Optimization

Before implementing a high probability trading strategy in live markets, backtesting is crucial. Traders use historical data to validate the effectiveness of their strategy. Optimization may also be necessary to fine-tune the strategy for current market conditions.

Trading Psychology and Mindset

The psychological aspect of trading plays a vital role in high probability trading. Fear, greed, and overconfidence can cloud judgment and lead to irrational decisions. Developing a disciplined and patient mindset is essential for consistent success.

Money Management Techniques

Money management is an integral part of high probability trading. Traders need to allocate their capital wisely, manage position sizes, and set appropriate risk-to-reward ratios for each trade.

Common Mistakes to Avoid

Traders new to high probability trading often make common mistakes that can hinder their success. These may include overtrading, ignoring risk management, chasing losses, and lacking a well-defined strategy.

Advantages and Disadvantages of High Probability Trading

Like any trading strategy, high probability trading has its pros and cons. Some advantages include a higher win rate and a focus on quality setups. However, it may require more significant price moves to generate substantial profits. Traders must carefully weigh these factors before adopting this approach.

Top Indicators for High Probability Trading

Several technical indicators are popular among high probability traders. These indicators can help identify potential trade opportunities and support decision-making. Some of the top indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

Conclusion

High probability trading is a systematic approach that offers traders an edge in the financial markets. By focusing on setups with higher odds of success and implementing robust risk management, traders can enhance their chances of achieving consistent profits. However, it is essential to remember that no strategy guarantees success, and traders should continuously adapt and improve their skills.

FAQs

What is high probability trading?

High probability trading involves seeking out trades with a higher likelihood of success based on statistical analysis.

How can I identify high probability setups?

Traders use a combination of technical and fundamental analysis to identify potential high probability setups.

Why is risk management crucial in high probability trading?

Strict risk management techniques help protect capital and prevent significant losses.

What role does technical analysis play in high probability trading?

Technical analysis helps identify entry and exit points using indicators and chart patterns.

Is high probability trading suitable for all traders?

High probability trading can be adopted by traders of all experience levels, but it requires discipline and emotional control.