Introduction

When it comes to trading in the financial markets, having a solid understanding of support and resistance levels is crucial. For traders in the Indian stock market, Bank Nifty plays a significant role. In this article, we will delve into the concept of support and resistance in the context of Bank Nifty and how you can use this knowledge to enhance your trading strategies. So, let’s get started!

1. Understanding Bank Nifty Support and Resistance

What is Support?

Support is a price level in a stock or an index where demand is strong enough to prevent further price decline. It acts as a floor, preventing the asset’s price from falling further. Traders and investors see this level as an opportunity to buy, expecting the stock or index to bounce back from that point.

What is Resistance?

Resistance, on the other hand, is a price level where the supply of a stock or an index exceeds the demand, causing the price to halt or reverse its upward trend. Traders perceive this level as an optimal selling opportunity, expecting the price to drop after reaching the resistance level.

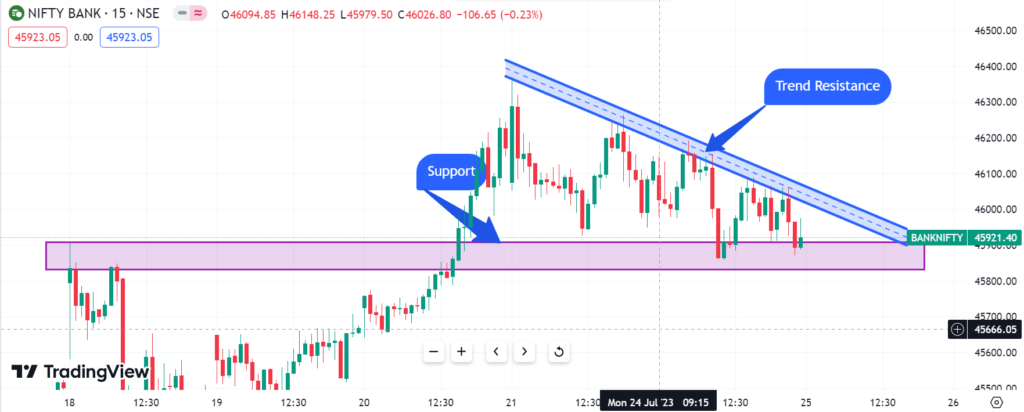

2. Identifying Bank Nifty Support and Resistance on Charts

To identify support and resistance levels on Bank Nifty charts, traders use technical analysis tools. The most common method is to observe historical price movements and identify areas where the price has reversed direction multiple times.

3. Importance of Support and Resistance Levels

Support and resistance levels are critical as they provide valuable insights into market sentiment. They help traders understand the balance between demand and supply, indicating potential price movements.

4. The Role of Volume in Confirming Support and Resistance

While identifying support and resistance, considering trading volume is vital. High trading volume at support or resistance levels confirms the significance of those levels.

5. Using Support and Resistance in Trading

Strategies

Traders can implement various strategies based on Bank Nifty Support and Resistance levels. Here are three common ones:

Breakout Trading Strategy

A breakout occurs when the price moves above a resistance level or below a support level. Traders may enter long positions after a breakout above resistance or short positions after a breakout below support.

Bounce Trading Strategy

In this strategy, traders buy near support and sell near resistance, expecting the price to bounce back from these levels.

Pullback Trading Strategy

Traders using this strategy wait for the price to pull back to a support level before entering long positions or to a resistance level before entering short positions.

6. Tips for Effectively Using Support and Resistance

Consider Multiple Time Frames

Examining support and resistance levels on various time frames helps traders make well-informed decisions.

Use Other Technical Indicators

Combining support and resistance analysis with other technical indicators improves trading accuracy.

Stay Informed About Market News

Market news and events can impact support and resistance levels, so it’s essential to stay informed.

7. Risk Management and Stop Loss Orders

Implementing risk management techniques, such as using stop-loss orders, is crucial to protect capital.

8. The Psychology Behind Support and Resistance

Understanding the psychology of traders at support and resistance levels can offer valuable insights into market behavior.

9. Common Mistakes to Avoid

Avoiding common pitfalls, such as chasing trends without confirmation or ignoring fundamental analysis, is vital.

10. Building a Trading Plan with Support and Resistance

Incorporate support and resistance analysis into your overall trading plan to improve consistency and profitability.

11. The Role of Technology in Analyzing Bank Nifty Support and Resistance

Utilizing advanced trading tools and software can enhance Bank Nifty Support and Resistance analysis.

12. Monitoring Bank Nifty Support and Resistance Levels

Support and resistance levels evolve over time, so regularly monitoring them is crucial for accurate predictions.

13. Case Studies: Successful Trades Using Support and Resistance

Examining real-world examples of profitable trades using support and resistance can provide valuable insights.

14. Conclusion

Support and resistance levels are fundamental pillars of technical analysis, especially in Bank Nifty trading. By understanding the concepts and incorporating them into your trading strategies, you can make informed decisions and improve your overall trading performance.

FAQs

-

What is the significance of support and resistance in trading?

Support and resistance levels are essential in trading because they provide valuable insights into market sentiment. Support acts as a price floor, preventing further decline, and is seen as an opportunity to buy. Resistance, on the other hand, acts as a price ceiling, causing the price to halt or reverse its upward trend, making it an optimal selling opportunity. Understanding these levels helps traders make informed decisions and predict potential price movements.

-

How can I identify Bank Nifty Support and Resistance levels ?

To identify support and resistance levels on Bank Nifty charts, you can use technical analysis tools. Look for areas on the chart where the price has reversed direction multiple times. These points indicate significant support and resistance levels. Additionally, consider using trading volume to confirm the importance of these levels.

-

What are some effective trading strategies using support and resistance?

There are several trading strategies based on support and resistance levels:

a) Breakout Trading Strategy: Enter long positions after a breakout above resistance or short positions after a breakout below support.

b) Bounce Trading Strategy: Buy near support and sell near resistance, expecting the price to bounce back from these levels.

c) Pullback Trading Strategy: Wait for the price to pull back to a support level before entering long positions or to a resistance level before entering short positions.

-

Is technical analysis alone sufficient for successful trading?

While technical analysis, including support and resistance analysis, is essential in trading, it is not the only factor to consider. Successful trading also requires a solid understanding of fundamental analysis, risk management techniques, market news, and psychological factors that can influence decision-making.

-

How do market events impact support and resistance levels?

Market events, such as economic data releases, corporate earnings reports, geopolitical events, and major news announcements, can impact support and resistance levels. These events can lead to increased volatility and may cause support or resistance levels to be broken or strengthened. Staying informed about market news is crucial to adapt to changing conditions and make well-informed trading decisions.